Introduction

Energy Transition projects just like other capital Investment projects must be appraised and evaluated to determine their viability or attractiveness. Two of the most important evaluation methods are Financial modelling and Economic modelling. In this article I want to briefly explain the similarities and the major differences between these two modelling techniques. It is a very common practice for many people to confuse the two and indeed even many professionals interchange their meanings without much thought to the technical definitions that makes a Financial model different from an Economical one.

The Differences

The list of differences is quite long, but here are the four main ones.

The first difference is Perspective: Financial modelling is from the perspective of the company or organisation undertaking the project, while economic modelling is from the perspective of the wider society or economic entity (e.g. town or country). So when you hear people say “this project is un-economical” it means it is not good for the wider audience (other than the organisation) because the costs are higher than the benefits. We face a major problem in the Energy Transition space in that most of the technological pathways to a low carbon energy supply are not yet economical because the costs (both financial and non-financial) are higher than the benefits.

The second difference is market versus non-market values:Financial modelling is concerned only with market values/prices, while economical modelling also considers non-market values such as costs or benefits to the environmental, employment, emissions, etc. Because it is not easy to put a value to non-market factors, there are country-specific agreed-on conventions on how to find non-market values (which sometimes are called shadow prices). For the UK, visit The Green Book to learn about some of those techniques.

The third difference is Profitability: Financial modelling is primarily concerned with how profitable or affordable a project is to the organisation. As such, issues of taxes, subsidies and depreciation are a major component of Financial modelling. On the other hand, Economical modelling is not concerned with profitability of the project but rather the net benefit (both cash and non-cash) to the wider society/community. Hence, issues of taxes, subsidies and depreciation don’t feature in project economical modelling. So when someone says ”this project is not economical without subsidies”, just know what the person is really saying is that the project is not economical , end of story. Subsidies to increase a project’s viability, are a clear indicator that a project is not economically viable. Billions of dollars are provided as subsidies by governments to incentivise investments in low carbon technologies to help companies financially so that they keep maturing the technologies so that in the future those technologies can become economical. A very good example of such subsidies are the Renewable Transportation Fuel Certificates (RTFC) that the UK government gives to suppliers of transportation fuel if it comes from a renewable source. Many Energy Transition pathways such as hydrogen are not yet economical given the present costs, demand, supply and technological maturity, but governments are betting that with subsidies they will be pushed along till they become economical in the long-term future.

The fourth difference is how Price Escalations are handled: While both models will consider price escalations over the years of the project, Economical modelling deals only with Real Prices (i.e. without inflation adjustment). Any changes to the prices over the years has to be analysed only based on real terms. For example if in five years’ time, a new process will be introduced that lowers the cost of something, that change in cost is real and it should be modelled without reference to inflation. On the other hand, Financial modelling deals with prices that escalate in real terms plus escalations due to inflation (the so called nominal prices). For the official inflation numbers to use, visit national offices for statistics and standards such as the UK’s Office of National Statistics. There are several inflation types one could pick from (e.g. inflation based on the CPI or RPI), so it is a good practice to use the appropriate inflation forecast for different project types and also for the short term versus the long term escalation. For more information about the topic of price escalation, check out The US Government Handbook on cost Escalation, which is produced by the US Department of Defence.

Similarities

I can think of two main similarities that people encounter when dealing with project financial or economical models.

Both models employ similar valuation metrics: Both financial and economical models use the metrics of NPV, IRR or ROI in order to decide on the viability of an investment. The minor difference is that by definition the Economical modelling metric like NPV could be different due to inclusion of non-market shadow prices.

Both use discounting cash flows: Both models employ the discounting of future cashflows, if you want to know the net cashflow at the present time by comparing apples to apples. The tricky part is the choice or calculation of the discount rate. Many modellers end up comparing apples and oranges if they pick a discount rate with inflation for Economical modelling or one without Inflation for Financial modelling. The standard discount rate is the Weighted Average Cost of Capital (WACC) which stands for the minimum rate of return that a company accepts for its investment decisions. Because the WACC as a Discount Rate is a cornerstone of Corporate Finance, it will indirectly have elements of inflation built in it. So, for Financial modelling it is common to use the WACC directly as the discount rate without adjustments. However, it is different for economical modelling. It is uber important that you adjust the WACC accordingly (to disregard effects of inflation) while doing economical modelling. This ensures consistency between the forward movement (price escalation minus inflation) and backward movement (discounting). Note: For public projects, I have come across Financial models that don’t employ discounting cashflows or the calculation of NPV. This is sufficiently okay if you consider the fact that the main objective of public financial modelling is to understand the affordability of the project over the years (to gauge funding or grant requirements) , not necessarily the net cashflows or NPV. Thus, the annual rolling cashflow deficits/surpluses become more important than the discounted cashflows or NPV.

For more details about understanding the differences and similarities of these two super important project evaluation methods the UK Guide on Delivering the Project Business Case is a good source.

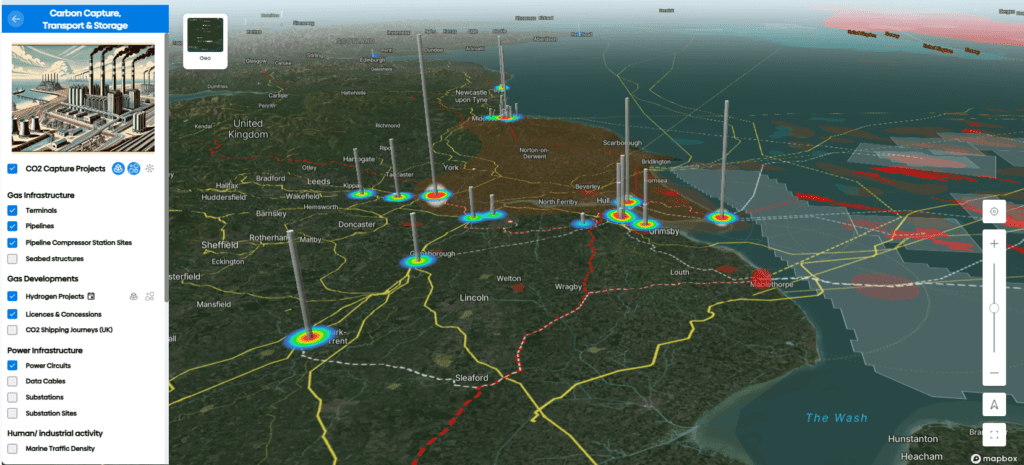

Olwg has created a proprietary Project Lifecycle Simulator that performs both Financial and Techno-Economical modelling of most Energy Transition pathways. Below is a screen shot for the Hydrogen Lifecycle Simulator that enables the simulation of over 9 different production technologies together with lifecycle economics and financials. The tool has a built-in Montecarlo simulator that models different risks into any of the values used.

Article written by: Emmanuel S. Kirunda (COO & Commercial Director of Olwg). You can reach him at emmanuel@olwg.co.uk for a demo of the Project Lifecycle Simulator.

References

- The UK Green Book https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/938046/The_Green_Book_2020.pdf

- US Gov Cost Escalation Handbook https://www.cape.osd.mil/files/Escalation%20Handbook__20170118.pdf

- The UK Office of National Statistics https://www.ons.gov.uk/

- Guide to Delivering The Project Business Case https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/749086/Project_Business_Case_2018.pdf